Trickle Charging (10km/hr)

Uses a standard power outlet, not recommended for non-residential charging

What grants, rebates and tax credits are available in each state right now (as of February 2024)

Electric vehicles (EV) are seeing ever-increasing market growth despite a slow start in Australia. The latest data shows sales of EVs February 2024 reached a record of 8% of new car sales.

To accelerate and support this shift, governments from each state are providing millions of dollars to support development of more charging infrastructure, both publicly and at home, reduce the cost of an EV via subsidies and stamp duty discounts.

With more than 7 years of experience in the electric fueling industry, EVSE Australia can help you find the funds you need to start your EV charging project.

Charging

Rebates for EV purchases:

$3,000 rebates for the first 25,000 EVs sold under

$68,750 from 1 September 2021.

Stamp Duty:

EVs under $78,000 will no longer pay stamp duty from 1 September 2021.

For eligible vehicles registered from 15 August 2022, the stamp duty exemption will be applied automatically. This will save you from any up-front duty costs.

Read more for current grants:

Learn more about EV Destination Charging Grants for Regional NSW here.

Learn more about NSW Fleet Grant

Learn more about EV Kerbside Charging Grant NSW here

Learn more about EV Charging Grant NSW for existing unit blocks here.

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Learn more about Round 3 Fast Charging Grants

Charging:

Incentives:

Vehicle Emission Reduction Scheme (VERS).

The VERS is aimed at promoting the acquisition of low-emission vehicles and mitigating the environmental effects of vehicles in the ACT. The payable duty is determined by the market value of the vehicle and its carbon dioxide emissions. From August 1, 2022, all electric or hydrogen fuel cell cars, whether new or used, will not be charged stamp duty in the ACT, irrespective of the vehicle’s age.

From the 1st of July 2022, employers do not pay fringe benefits tax (FBT) on eligible zero or low emissions vehicles. This makes it more affordable to lease an EV or PHEV through your employer.

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Learn more about Business Electric Vehicle Charger Pilot

Charging:

• The Electric Vehicle Charger (Residential and Business) Grants Scheme provides funding to buy and install a charger at your residential property or business, with grants of up to:

– $1,000 for a residential property

– $2,500 for a business

The scheme will be open from 1 July 2022 and will be administered on a first-come,

first-served basis.

Stamp Duty

From July 2022 until 30th June 2027, there will be no stamp duty fees for EVs up to $50,000 or annual registration fee for EVs

Learn More: NT Electric Vehicle Charger Grants Scheme

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Charging:

Subsidy:

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Charging:

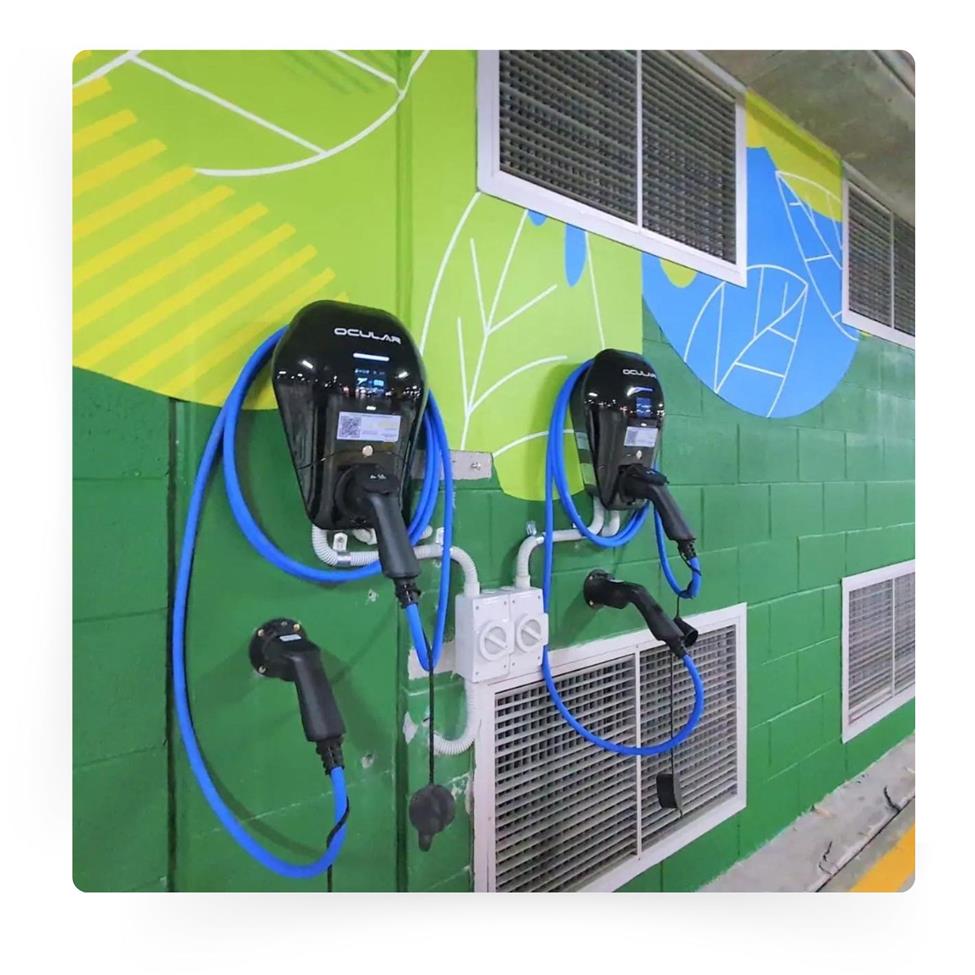

• Injection of $20 million to support the creation of an electric vehicle charging infrastructure network.

• Investment of $800,000 towards government buildings for the installation of charging stations to support State Government electric vehicle fleet targets

•$10 million over 2022-23 and 2023-24 for Energy Policy WA to deliver grants of up to 50% of the cost of installing electric vehicle charging infrastructure for not-for-profits, and small and medium-sized businesses. Learn how to apply here

Learn more: EV Charging Grants WA (Western Australia) | EVSE Australia

Rebates:

$3,500 rebate for the first 10,000 people who buy electric cars valued under $70,000

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

EV Rebate:

Stamp Duty

Charging

Grants delivered more than $600,000 in their first round and the second round (2021) allocated $773,000 for 20 fast charging stations and 23 destination chargers across regional areas and tourism hotspots.

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Subsidies

Charging

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Charging

Learn more about Community Energy Upgrades Fund for LGAs Australia-Wide

Moving or expanding your business to New Zealand? There are various subsidies and grants offered to individuals and businesses interested in purchasing electric vehicles (EVs). These incentives are designed to make EVs more accessible and affordable for consumers, promoting the adoption of cleaner and greener transportation options.

Learn more about NZ EV Grants & Incentives

EVSE believes in a green sustainable future by delivering the latest EV Charging technology at the lowest price. All our work is certified and guaranteed with the backing of global brands.

Our team of experts can provide specialist EVSE advice and are available to answer any of your questions over the phone

Tell us about your car and home to see recommendations.

Stocking the best Electric Car products from the World’s leading brands.

All of our EVSE products are compliant with Australian & International standards.